SECTORS

Agricultural Programs

NGOs that run agricultural programs play a crucial role in lifting communities out of poverty. Central to these initiatives is a common challenge: effectively collecting clean data and measuring the impact of their agricultural extension, finance, cooperative, and logistics programs across various landscapes.

Explore how CommCare addresses these unique challenges, amplifying agricultural program effectiveness through increased crop yields for farmers, while fostering sustainable growth. From mitigating spatial and consistency issues for agricultural extension agents to streamlining the management of complex cooperative farming endeavors, CommCare is the preferred digital partner in the fight against hunger.

Agricultural Extension Programs

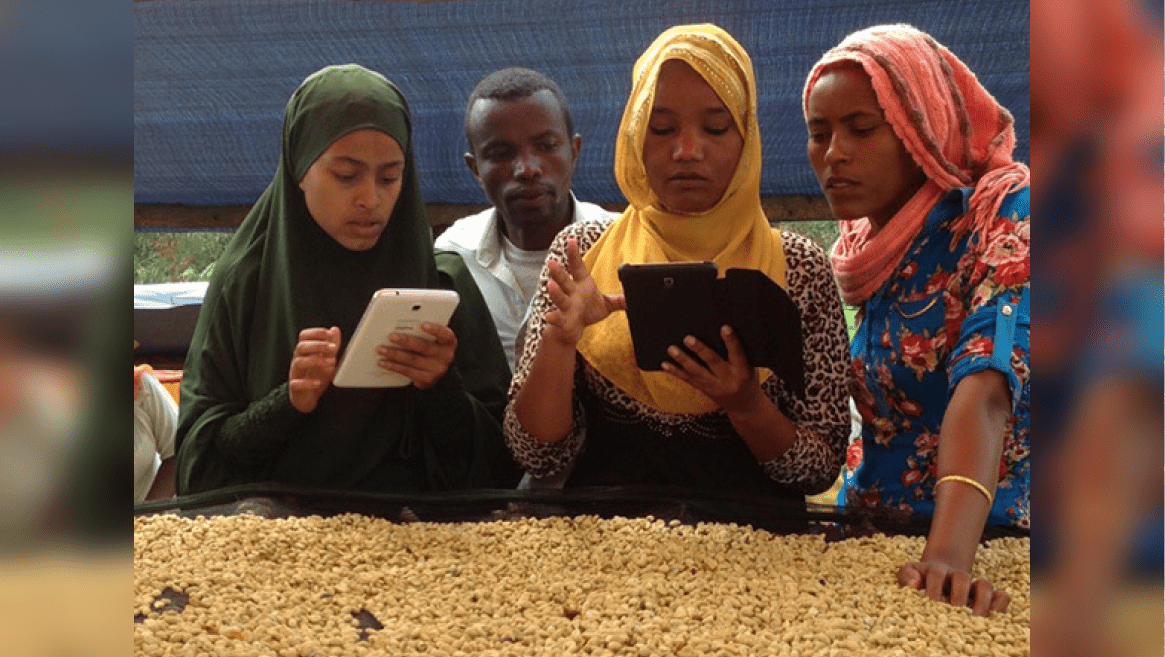

Agricultural extension programs play a crucial role in enhancing both yields and incomes for farmers by employing trained agents who actively visit communities to facilitate the dissemination of up-to-date best practices, organize cooperatives, and implement additional programs. These dedicated agricultural workers are tasked with extensive travel throughout their countries while upholding a standard of consistent and high-quality work, often within constraints of limited training and resources.

By leveraging CommCare, these agents are able to mitigate challenges related to spatial coverage and maintain a consistent level of service delivery, ultimately leading to more effective and sustainable agricultural extension initiatives.

Benefits of Mobile Data Collection in Agricultural Extension Programs

Mobile apps can support online and offline data collection, facilitate record keeping, and generate easily shareable reports for farming supervisors.

Registration and case sharing enable tracking across visits, facilitating continuum of personalized training according to crop, farm size, & technique.

Multimedia integrations offer more engaging worker trainings, ensuring correct information is shared, while increasing worker performance.

Interaction with servers ensures market and technical information is accurate and up-to-date.

Decision support and checklists increase adherence to protocols, improving extension agents’ performance and efficiency.

Mobile apps and SMS can send reminders to extension agents to follow up on low-performing farmers.

Agricultural Finance Programs

The explosion of microfinance and insurance institutions (MFIs) has provided alternative sources of capital and security for small-scale farmers. Availability to Microfinance and insurance options allow agricultural communities to reduce investment risk, as well as provide the growth capital needed to thrive.

However, while microfinance and insurance have allowed farmers to increase crop yields through new investments, the penetration rates in rural rates — where capital and risk hedging is needed most — still lag behind other geographies. Complex dataflows and poor infrastructures lead to impossible demands on finance, insurance, and credit officers. Only robust, off-grid IT solutions can help expand financial tools to the millions that require them to help expand their businesses.

Benefits of Mobile Data Collection in Agricultural Finance Programs

Offline capabilities support individual loan tracking without large amounts of paperwork that get lost or destroyed in remote locations.

Complex logic reduces data entry needs to allow for quicker turn-around times in remote locations, allowing officers to visit more customers or customers in farther locations.

SMS capabilities allow farmers to receive confirmation of payment history, allowing them to build up credit for higher loan amounts in the future.

Cloud-hosting allows management to remotely view and monitor loan books in real-time, reducing their risk portfolio and allowing for increased leading to new markets.

Agricultural Logistics Programs

Modern supply chain tools require heavy investments in training, computer infrastructure, and communications which developing countries may not be able to afford with closed-source or custom development solutions.

Inefficient power supplies, poor internet penetration rates, and high capital costs mean that most systems used in developed countries are not transposable to low-resource settings, often leading to stock-outs of important agricultural inputs. The right mobile tool can serve as a low cost, robust platform capable of alleviating issues related to logistics, distribution, and management of food systems.

CommCare, which has been deployed nationally in several countries as a last-mile value-chain system for reducing stock-outs of health supplies, can also be used to manage input distribution, the cold chain of perishable goods, and warehouse receipt systems at a lower cost than complex custom-built systems.

Benefits of Mobile Data Collection in Agricultural Logistics Programs

Multimedia capabilities allow supervisors to include photos of produce being stocked, improving the effectiveness of quality control efforts.

Open solutions allow for greater flexibility in potential value-chain logistics.

Offline capabilities allow the application to be used in even the most rural, underserved communities.

Decision support and checklists increase adherence to protocols, improving extension agents’ performance and efficiency.

Complex geo-referencing data-types are reduced to intuitive, localized stock ledgers to reduce training requirements.

Case management capabilities allow stock supervisors to quickly enter product quantities and suppliers for follow-up and re-stocking.

Agricultural Cooperative Programs

Cooperative farming holds the most potential for rural farmers to lift themselves out of poverty through their collective expertise and combined efficiencies. For many farmers, discounts on inputs and increased market access have resulted in unprecedented increases in income.

However, cooperatives become exponentially more complex to manage as they scale. The administrative burden of large memberships creates an artificial limitation to their size.

Management applications and mobile tools help cooperatives reduce this management burden, allowing them to dramatically increase memberships without increasing complexity.

Benefits of Mobile Data Collection in Agricultural Cooperative Programs

Complex calculations and data tracking help cooperatives with data-driven financial planning

Offline capabilities allow the application to be used in even the most rural, underserved communities.

Mobile workflows can virtually consolidate bulk selling and out-grower schemes to move cooperatives higher up the value chain, improving margins.

Multimedia capabilities allow for the distribution of best practices amongst cooperative members for improved and more consistent training.

Case management capabilities allow cooperative administrators to keep track of individual farmer needs and outputs.

Featured CommCare-Based Agricultural Programs

TechnoServe: Building and M&E Tools Suite

For over 50 years, TechnoServe has created impact in 30+ countries, reaching almost 500,000 beneficiaries across sectors in Latin America, Africa, and India. To improve M&E needs, the organization restructured its team and developed a suite of products that streamline data capture, management, and analysis, reducing implementation time.

Naatal Mbay: CommCare for Agricultural Support

Naatal Mbay, a Feed the Future project, uses digital tools like CommCare and CommAgri to support farmer-serving organizations in Senegal’s rice, maize, and millet value chains. The program enables tracking of inputs, productivity, loan management, and rainfall data. Currently, 55 cooperatives and 500 extension agents have registered 68,000 farmers through the digital tool.

Check out the demo to see how CommCare works in action

More than 2000 projects across 130+ countries rely on CommCare for their mobile data collection and reporting needs

Noukod

“We are ready to design applications that are everything from simple and straightforward to those with challenging and unique designs and use cases.”

- Ted Barlow, President

Sehgal Foundation

“CommCare gave us the ability to control the experience of our fieldbased data collectors, which drastically reduced human error.”

- Bhawna Mangla, Senior Research Associate

Let There Be Light International

“Thank you for helping us to gather data, refine programming, and spread the message about our impact in fighting global climate change and extreme poverty.”

- Sarah Baird, Executive Director

Explore

CommCare

Build secure, customizable apps, enabling your frontline teams to collect actionable data and amplify your organization’s impact.

Sectors Using CommCare

Learn about the various sectors using CommCare to amplify their programs.

Impact Delivery

Unlock the full potential of digital with a robust, sustainable approach that maximizes impact today and sets the foundation for tomorrow’s success.